News

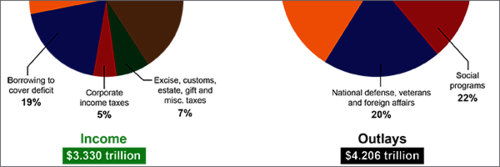

Finding the Balance of Income vs. Spending

2/5/2020

Every year the IRS publishes instructions to prepare your Form 1040, individual tax return. The publication for 2019 is a whopping 108 pages! On page 103 of the IRS booklet is a summary of collections (income) and spending (outlays) by the federal...

READ MORE >

New Rules Mean Saving More for Retirement

2/5/2020

The Setting Every Community Up for Retirement Enhancement Act, also known as the SECURE Act, was passed by Congress in late December 2019. Here are some of the features in the new legislation that will help you save more for retirement:

Money can...

READ MORE >

New W-4 Creates Questions for Human Resources

2/5/2020

With the major Form W-4 overhaul for 2020, you may field questions from your employees concerning their federal paycheck tax withholdings. While it’s not your responsibility to provide tax advice to your employees, it’s good to be...

READ MORE >

415 Group Adds Five Accounting Associates and Six Interns to Growing Firm

1/8/2020

415 Group, a certified public accounting, business consulting and IT services firm, announced today the hiring of five accounting associates, one administrative assistant and six interns to its growing team.

“We’re excited to expand our...

READ MORE >

Make Your Cash Worth More

1/2/2020

Your cash is parked. Do you know if it's making or losing you money? For instance, letting it sit in a non-interest-bearing account is a waste of earnings potential. It’s actually losing money if you factor in inflation! Here are some ideas to...

READ MORE >

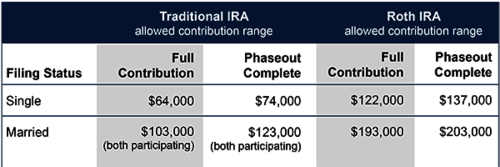

There's Still Time to Fund Your IRA

1/2/2020

There is still time to make a contribution to a traditional IRA or Roth IRA for the 2019 tax year. The annual contribution limit is $6,000 or $7,000 if you are age 50 or over.

Prior to making a contribution, if you (or your spouse) are an active...

READ MORE >

2020 Retirement Plan Limits

1/2/2020

As part of your 2020 planning, now is the time to review funding your retirement accounts. By establishing your contribution goals at the beginning of each year, the financial impact of saving for your future should be more manageable. Here are...

READ MORE >

415 Group Promotes Associates, Strengthens Team

12/23/2019

415 Group, a certified public accounting, business consulting and IT services firm, today announced the promotions of seven associates to leadership positions.

“We’re excited to elevate these individuals as they continue to demonstrate...

READ MORE >

Save Money With These Year-End Ideas

12/5/2019

There's still time to reduce your potential tax obligation and save money this year (and next). Here are some ideas to consider:

Estimate your 2019 and 2020 taxable income. With these estimates you can determine which year receives the...

Includes insights from Holly L. Lieser

READ MORE >

Time for a Yearly Credit Report

12/4/2019

One way to head off fraud during tax season is to get your free annual credit report now. Credit reports often have errors in them; this quick checkup can be the first indication that some form of identity theft has taken place on your account.

The...

READ MORE >

3 Major Charity Scam Red Flags

12/4/2019

You’ve probably already received several letters and phone calls from charities asking for donations. Most requests are from legitimate organizations. Some, however, are bogus charities set up by con artists who use the holiday spirit to their...

READ MORE >

Cash Flow: A Central Part of Your Business Plan

12/4/2019

When tracking and planning your business objectives, it’s easy to focus your analysis on two reports — the income statement and balance sheet. But one of the primary keys to your business’s success relies more on how you handle the...

READ MORE >

Reminder: Major Employment Tax Deadlines

11/18/2019

Handling employment taxes can be complicated, especially when you’re required to file important tax documents throughout the year. Here's a list of key forms and deadline dates to help keep you on track.

Form 941 — Employer's quarterly...

READ MORE >

415 Group Pledges $40,000 to Downtown Canton Plaza Construction

11/13/2019

415 Group recently pledged $40,000 toward the construction of Centennial Plaza in Downtown Canton.

The plaza will cost $12.3 million to build. Funding is coming from taxes, the state of Ohio, and private donations from local and state leaders and...

READ MORE >

Another Year, Another New 1040

10/9/2019

In 2018, the government attempted to “simplify” the tax-filing process by drastically shortening Form 1040. The result was six new schedules that created a lot of confusion. Now the IRS is attempting to ease some of that pain by revising...

READ MORE >

Reminder: Time to Start the Financial Aid Process

10/9/2019

If you have a child in college or entering college during the next school year, you need to read this. You can now fill out your required Free Application for Financial Student Aid (FAFSA) for the next school year.

FAFSA...

READ MORE >

Amazon and eBay Sales Tax Alert

10/9/2019

If you or your business sells product on Amazon using the Fulfillment by Amazon (FBA) service, you are well into the multi-state sales tax mess ... even if you are not aware of it. You may be asking yourself:

Do I now need to...

READ MORE >

415 Group Partner Scott Whetstone Announces Retirement

9/18/2019

415 Group announced today that Partner Scott Whetstone, CPA, MT, will retire on Nov. 4.

“Having worked for more than four decades in the public accounting field, it’s a bittersweet decision to retire,” said Whetstone....

READ MORE >

The IRS Is Not Always Right

9/17/2019

A letter in the mailbox with the IRS as the return address is sure to raise your blood pressure. Here are some tips for handling the situation if this happens to you:

Stay calm. Try not to overreact to the correspondence. They are often in...

READ MORE >

Help Older Adults Stand Up Against Scams

9/17/2019

The Consumer Financial Protection Bureau recently reported in financial exploitation cases that older adults lost an average of $34,200. Unfortunately, these funds are often never recovered. You can ensure this doesn't happen by learning more about...

READ MORE >