Every year the IRS publishes instructions to prepare your Form 1040, individual tax return. The publication for 2019 is a whopping 108 pages! On page 103 of the IRS booklet is a summary of collections (income) and spending (outlays) by the federal government. Given the election year, here is a summary of this recap and some general observations.*

Observations

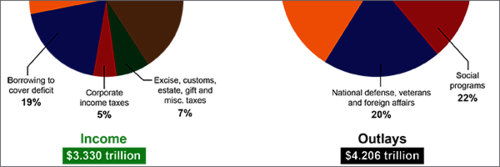

23%: The amount of annual spending with no income to cover it.

63%: The amount of spending for social programs, Social Security and Medicare.

20%: National defense (15%), veterans benefits (4%), foreign aid (1%)

8%: Amount of annual budget required to pay interest on prior year deficits.

Why care?

- Get rid of the noise. Political rhetoric is often high during election season, and it is nice to have some facts as to how our taxes are actually spent.

- Ah ha…this is a key reason interest rates are low. Wondering why your bank savings interest rate is so low? In part it is because they are related to federally set interest rates. Imagine if the federal interest rates doubled. The amount of our government’s spending on interest payments would double to 16 percent!

- Very little is optional. Debt payments, veteran obligations, Social Security, Medicare - all these payments plus many others are mandatory. These amounts alone, are over 75% of spending.

- Start the conversation. Currently, very little of the national conversation is centered around fiscal responsibility (the act of balancing income and outlays). No matter the side of your political leaning, perhaps this should be a starting point for everyone.

- Learning for all of us. Take a lesson here and see how your household income and spending stack up. Then create a plan to balance your income and outlays. Use tax planning as one of the key tools to do this.

Want to learn more?

The website www.usafacts.org is a great resource for an objective review of the numbers. This nonprofit is committed to providing the figures and letting you decide what they mean to you.

Or, contact us today to learn about our tax services. We can help you with your tax returns, tax projections and more.

*for the fiscal year 2018 ending September 30, 2018.