News

Personal Tax

Back-to-school tax breaks on the books

9/1/2020

Despite the COVID-19 pandemic, students are going back to school this fall, either remotely, in-person or under a hybrid schedule. In any event, parents may be eligible for certain tax breaks to help defray the cost of education.

Here is a summary...

READ MORE >

Will You Have to Pay Tax on Your Social Security Benefits?

8/25/2020

If you’re getting close to retirement, you may wonder: Are my Social Security benefits going to be taxed? And if so, how much will you have to pay?

It depends on your other income. If you’re taxed, between 50% and 85% of your benefits...

READ MORE >

What happens if an individual can’t pay taxes

8/18/2020

While you probably don’t have any problems paying your tax bills, you may wonder: What happens in the event you (or someone you know) can’t pay taxes on time? Here’s a look at the options.

Most importantly, don’t let the...

READ MORE >

More parents may owe “nanny tax” this year, due to COVID-19

8/11/2020

In the COVID-19 era, many parents are hiring nannies and babysitters because their daycare centers and summer camps have closed. This may result in federal “nanny tax” obligations.

Keep in mind that the nanny tax may apply to all...

READ MORE >

The tax implications of employer-provided life insurance

8/4/2020

Does your employer provide you with group term life insurance? If so, and if the coverage is higher than $50,000, this employee benefit may create undesirable income tax consequences for you.

“Phantom income”

The first $50,000 of group...

READ MORE >

Are scholarships tax-free or taxable?

7/28/2020

COVID-19 is changing the landscape for many schools this fall. But many children and young adults are going back, even if it’s just for online learning, and some parents will be facing tuition bills. If your child has been awarded a...

READ MORE >

Conduct a “paycheck checkup” to make sure your withholding is adequate

7/16/2020

Did you recently file your federal tax return and were surprised to find you owed money? You might want to change your withholding so that this doesn’t happen next year. You might even want to do that if you got a big refund. Receiving a tax...

READ MORE >

IRS guidance provides RMD rollover relief

7/2/2020

The CARES Act was enacted in an attempt to mitigate the economic effects of the COVID-19 pandemic. Among other things, it extends favorable tax treatment to qualified individuals who take so-called “coronavirus-related distributions”...

READ MORE >

Think Before Tapping 401(k) as Emergency Fund

6/12/2020

Do you need a quick infusion of cash?

Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, you may be able to take money out of a qualified plan, like a 401(k), or an IRA, with favorable tax consequences. But should you do it? You...

READ MORE >

Ideas to Help Make Payments During Tough Times

5/15/2020

You’re not alone in trying to navigate the financial uncertainty during the coronavirus pandemic. Millions of American workers who lost their paycheck because of COVID-19 need to find creative ways to pay bills.

Here are 6 ways to get cash to...

READ MORE >

IRS Extends More Tax Deadlines to July 15

4/13/2020

The April 15 federal income tax filing due date has been moved to July 15, the U.S. Treasury Department and IRS recently announced. Here is what you need to know:

The due dates for all tax payments normally due April 15 have been pushed back 90...

READ MORE >

Keep Your Social Security Number Safe

4/3/2020

Countries and citizens around the world are banding together to defeat the coronavirus. While your attention is concentrated on protecting your family, friends and community, identity thieves are seeing an opportunity to swipe your confidential...

READ MORE >

Additional Paid Leave for Workers Affected by COVID-19

3/31/2020

The Families First Coronavirus Response Act is a new program that offers COVID-19 assistance for both employees and employers.

This new law provides businesses with fewer than 500 employees the funds to provide employees with paid leave, either for...

READ MORE >

Who Qualifies for COVID-19 Stimulus Payments?

3/31/2020

The Coronavirus Aid, Relief, and Economic Security (CARES) Act recently signed into law provides a one-time payment, among other items, to individuals to help ease the economic strain caused by the coronavirus epidemic.

Here are the details of the...

READ MORE >

COVID-19 Bill Enhances Your Unemployment Benefits

3/31/2020

The recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act provides individuals and businesses significant financial relief from the financial strain caused by the coronavirus epidemic.

Here is a snapshot of the unemployment...

READ MORE >

Ease the Pain of Repaying Student Loans

3/4/2020

Student loan debt is a hot topic and for good reason. Managing the burden that comes during repayment is very difficult. Fortunately, there are ways to get some relief while taking advantage of timely tax breaks at the same time. Here are four ways...

READ MORE >

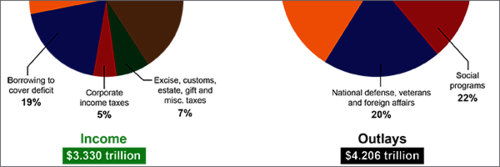

Finding the Balance of Income vs. Spending

2/5/2020

Every year the IRS publishes instructions to prepare your Form 1040, individual tax return. The publication for 2019 is a whopping 108 pages! On page 103 of the IRS booklet is a summary of collections (income) and spending (outlays) by the federal...

READ MORE >

New Rules Mean Saving More for Retirement

2/5/2020

The Setting Every Community Up for Retirement Enhancement Act, also known as the SECURE Act, was passed by Congress in late December 2019. Here are some of the features in the new legislation that will help you save more for retirement:

Money can...

READ MORE >

Make Your Cash Worth More

1/2/2020

Your cash is parked. Do you know if it's making or losing you money? For instance, letting it sit in a non-interest-bearing account is a waste of earnings potential. It’s actually losing money if you factor in inflation! Here are some ideas to...

READ MORE >

2020 Retirement Plan Limits

1/2/2020

As part of your 2020 planning, now is the time to review funding your retirement accounts. By establishing your contribution goals at the beginning of each year, the financial impact of saving for your future should be more manageable. Here are...

READ MORE >