News

Factoring Uncertainty into the Value of Your Business

2/13/2017

Businesses currently face numerous uncertainties in the marketplace.As President Trump and Republican congressional leaders work toward fulfilling their campaign promises, tax laws could substantially change, the estate tax could be repealed, and...

READ MORE >

Protecting Wire Transfers

2/13/2017

If your company uses wire transfers, you've solved some of the headaches involved with paper checks. With wire transfers, you know that a payment arrived and isn't "lost in the mail." You also avoid some of the risks of forgery and other check fraud...

READ MORE >

IRS Allows Exceptions for Missed Retirement Account Rollover Deadlines

2/13/2017

You may know about the 60-day window for making tax-free rollovers of funds withdrawn from your IRA or other tax-favored retirement account. Here are a couple of things you might not know about the deadline:

1. The 60-day period begins the day...

READ MORE >

What you need to know about the tax treatment of ISOs

2/8/2017

Incentive stock options allow you to buy company stock in the future at a fixed price equal to or greater than the stock’s fair market value on the grant date. If the stock appreciates, you can buy shares at a price below what they’re...

READ MORE >

PTO banks: A smart HR solution for many companies

2/1/2017

“I’m taking a sick day!” This familiar refrain usually is uttered with just cause, but not always. What if there were no sick days? No, we’re not suggesting employees be forced to work when they’re under the weather....

READ MORE >

Is your business committed to its cost-control regimen?

1/30/2017

At the beginning of the year, many people decide they’re going to get in the best shape of their lives. Similarly, many business owners declare that they intend to cut costs and operate at peak efficiency going forward.

But, like keeping up...

READ MORE >

IRS Reports a Significant Increase in Whistleblower Awards

1/27/2017

The IRS Whistleblower Office is celebrating its 10-year anniversary this year. The office was created under the Tax Relief and Health Care Act of 2006 to oversee the IRS whistleblower program, which is a critical part of overall enforcement and...

READ MORE >

IRS Updates FAQs on Certain ACA Provisions

1/27/2017

The Trump Administration and the Republican majority in Congress plan to repeal and replace the Affordable Care Act (ACA) in the coming months. In the meantime, however, employers must continue to comply with the existing rules for 2016, including...

READ MORE >

Non-Compete Agreements: What Can They Accomplish?

1/27/2017

It may seem ironic that companies encourage innovation and brilliance while employees are on the payroll, but pull the plug on that ambition if they dare to leave. But non-compete agreements attempt to do just that to control...

READ MORE >

Maximize Write-Offs for Business Interest Expense

1/27/2017

When you take out personal loans to buy a business, you want to maximize the tax write-offs for the resulting interest expense. The tax law in this area is tricky. But if you play your cards right, you can get the best possible...

READ MORE >

Strive to Protect Nursing Home Employees from Patients

1/27/2017

Nursing homes are potentially one of the most dangerous workplaces in the country. Nursing assistants in long-term care facilities have the highest incidence of assaults of all American workers, with one study showing that 27 percent of all...

READ MORE >

Succession planning and estate planning must go hand in hand

1/24/2017

As the saying goes, nothing lasts forever — and that goes for most companies. Then again, with the right succession plan in place, you can do your part to ensure your business continues down a path of success for at least another generation....

READ MORE >

Deduction for state and local sales tax benefits some, but not all, taxpayers

1/24/2017

The break allowing taxpayers to take an itemized deduction for state and local sales taxes in lieu of state and local income taxes was made “permanent” a little over a year ago. This break can be valuable to those residing in states with...

READ MORE >

Consider State Taxes When Deciding Where to Live in Retirement

1/16/2017

When you retire, you may consider moving to another state — say, for the weather or to be closer to loved ones. State taxes also may factor into the equation. Here's what you need to know about establishing residency for state tax purposes...

READ MORE >

Executive Terminations: Sever Ties Carefully

1/16/2017

Firing someone in a big corporation is hard enough. In a smaller company, it can be a very personal issue. And if you do a bad job handling the firing of an executive in a close-knit company, the results can be disastrous.

It's difficult to get...

READ MORE >

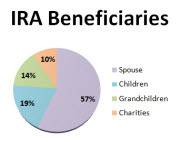

Leaving IRA Money to Charity: A Tax-Smart Strategy

1/16/2017

These days, many people have a large percentage of their wealth in the form of traditional IRA accounts. In most cases, this is because significant distributions have been rolled over tax-free from qualified retirement plans to these IRAs. A lot of...

READ MORE >

415 Group Expands Information Technology Team with Acquisition of Proactive IT Solutions

1/16/2017

CANTON, Ohio — 415 Group announced today the acquisition of Proactive IT Solutions, a technology firm located in Salem, Ohio.

415 Group is a full-service professional firm providing information technology (IT) solutions, certified public...

READ MORE >

Help prevent tax identity theft by filing early

1/11/2017

If you’re like many Americans, you might not start thinking about filing your tax return until close to this year’s April 18 deadline. You might even want to file for an extension so you don’t have to send your return to the IRS...

READ MORE >

Considering a spinoff? Think it through

1/3/2017

In popular culture, the word “spinoff” usually refers to a television show whose main characters originated from an already established show. But the word applies to the business world, too. Here it describes a division or subsidiary of...

READ MORE >

Few changes to retirement plan contribution limits for 2017

1/3/2017

Retirement plan contribution limits are indexed for inflation, but with inflation remaining low, most of the limits remain unchanged for 2017. The only limit that has increased from the 2016 level is for contributions to defined contribution plans,...

READ MORE >