News

Don't Leave Your Business Exposed

5/22/2019

Have you conducted a business insurance review lately? Changes in your business equipment, real estate holdings, the amount of inventory, and the number of employees are all good reasons to review your insurance. Here are a few policy review tips to...

READ MORE >

Every Business Needs Cash

3/25/2019

Focusing solely on sales and profits can create a surprise for any business when there is not enough cash to pay the bills. Here are five key principals to improve your cash management.

Create a cash flow statement and analyze it...

Includes insights from Chad R. Isler

READ MORE >

7 Common Missing Tax Return Items

3/18/2019

Want your tax return filed quickly and without error? Then double-check this list of items that are often overlooked. These missing items often cause delays in getting your tax return filed:

Forms W-2 and 1099. Using last year's tax return...

READ MORE >

Oh No! Your Tax Refund is Now a Bill

3/18/2019

If you are anticipating a nice refund this year, it may be a good idea to prepare yourself for a possible letdown. Many taxpayers will receive a smaller-than-expected refund and might even owe taxes to be paid by April 15. If this happens to you,...

READ MORE >

QuickBooks Online: Five time-saving tips for your business

3/5/2019

A powerful tool for your business, QuickBooks Online (QBO) software makes collaboration with your accounting team seamless. Learning the ins and outs can save you time and boost your productivity. Use these five time-saving tips to transform your...

Includes insights from Barbara D. Hupp

READ MORE >

Tips to Protect Yourself From Tax Scams

2/20/2019

Too many people downplay the threat of identity theft because it hasn't been witnessed or experienced firsthand. This false sense of security can leave you exposed, especially during tax season. Here are some tips to keep your identity safe from...

READ MORE >

7 Tax-Free Ideas to Bolster Your Business Benefits Package

2/20/2019

The benefits package offered by your business is extremely important to your employees. How important? A survey performed by the Society of Human Resource Management (SHRM) found that benefits are directly tied to overall job satisfaction for 92...

READ MORE >

Financial statements tell your business’s story, inside and out

2/18/2019

Ask many entrepreneurs and small business owners to show you their financial statements and they’ll likely open a laptop and show you their bookkeeping software. Although tracking financial transactions is critical, spreadsheets aren’t...

READ MORE >

Why you shouldn’t wait to file your 2018 income tax return

2/18/2019

The IRS opened the 2018 income tax return filing season on January 28. Even if you typically don’t file until much closer to the April 15 deadline, this year consider filing as soon as you can. Why? You can potentially protect yourself from...

READ MORE >

3 big TCJA changes affecting 2018 individual tax returns and beyond

2/18/2019

When you file your 2018 income tax return, you’ll likely find that some big tax law changes affect you — besides the much-discussed tax rate cuts and reduced itemized deductions. For 2018 through 2025, the Tax Cuts and Jobs Act (TCJA)...

READ MORE >

Best practices when filing a business interruption claim

2/18/2019

Many companies, especially those that operate in areas prone to natural disasters, should consider business interruption insurance. Unlike a commercial property policy, which may cover certain repairs of damaged property, this coverage generally...

READ MORE >

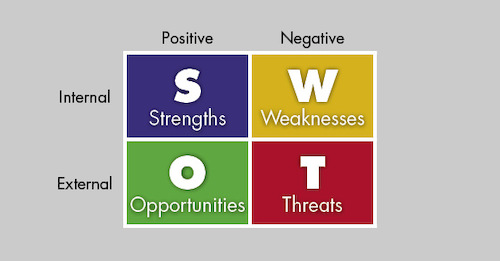

Refine your strategic plan with SWOT

1/31/2019

With the year underway, your business probably has a strategic plan in place for the months ahead. Or maybe you’ve created a general outline but haven’t quite put the finishing touches on it yet. In either case, there’s a...

READ MORE >

Depreciation-related breaks on business real estate: What you need to know when you file your 2018 return

1/30/2019

Commercial buildings and improvements generally are depreciated over 39 years, which essentially means you can deduct a portion of the cost every year over the depreciation period. (Land isn’t depreciable.) But special tax breaks that allow...

READ MORE >

There’s still time to get substantiation for 2018 donations

1/22/2019

If you’re like many Americans, letters from your favorite charities have been appearing in your mailbox in recent weeks acknowledging your 2018 year-end donations. But what happens if you haven’t received such a letter — can you...

READ MORE >

It's Your Money. Get it Back Now!

1/21/2019

According to Credit Karma, over $40 BILLION of unclaimed property is currently being held by state governments. That's a staggering amount of money — enough to buy half of the National Football League franchises. Not included in that figure is...

Includes insights from Kathleen S. Krohn

READ MORE >

Getting wise to the rise of “smart” buildings

1/16/2019

Nowadays, data drives everything — including the very buildings in which companies operate. If your business is considering upgrading its current facility, or moving to or constructing a new one, it’s important to be aware of...

READ MORE >

What will your marginal income tax rate be?

1/15/2019

While the Tax Cuts and Jobs Act (TCJA) generally reduced individual tax rates for 2018 through 2025, some taxpayers could see their taxes go up due to reductions or eliminations of certain tax breaks — and, in some cases, due to their filing...

READ MORE >

4 business functions you could outsource right now

1/9/2019

One thing in plentiful supply in today’s business world is help. Orbiting every industry are providers, consultancies and independent contractors offering a wide array of support services. Simply put, it’s never been easier to outsource...

READ MORE >

2 major tax law changes for individuals in 2019

1/8/2019

While most provisions of the Tax Cuts and Jobs Act (TCJA) went into effect in 2018 and either apply through 2025 or are permanent, there are two major changes under the act for 2019. Here’s a closer look.

1. Medical expense deduction...

READ MORE >

Hey Alexa. Are you Making Me Dumb?

1/2/2019

3 concerns to consider while living with a smart speaker

Smart speakers like the Amazon Echo and Google Home are popping up everywhere. According to a Nielsen study from last September, nearly one of every four U.S. households has a smart...

READ MORE >