News

Year-end tax planning strategies must take business turbulence into account

10/27/2020

Election years often lead to uncertainty for businesses, but 2020 surely takes the cake when it comes to unpredictability. Amid the chaos of the COVID-19 pandemic, the resulting economic downturn and civil unrest, businesses are on their yearly...

READ MORE >

Buying and selling mutual fund shares: Avoid these tax pitfalls

10/21/2020

If you invest in mutual funds, be aware of some potential pitfalls involved in buying and selling shares.

Surprise sales

You may already have made taxable “sales” of part of your mutual fund investment without knowing it.

One...

READ MORE >

The 2021 “Social Security wage base” is increasing

10/21/2020

If your small business is planning for payroll next year, be aware that the “Social Security wage base” is increasing.

The Social Security Administration recently announced that the maximum earnings subject to Social Security tax will...

READ MORE >

Unusual year steers year-end tax strategies

10/21/2020

Like so many things this year, the recommended practices for your annual end-of-the-year tax planning reflect the COVID-19 pandemic and its far-flung effects. The economic impact, as well as federal relief packages like the CARES Act, may render...

READ MORE >

Avoiding conflicts of interest with auditors

10/16/2020

A conflict of interest could impair your auditor’s objectivity and integrity and potentially compromise you company’s financial statements. That’s why it’s important to identify and manage potential conflicts of...

READ MORE >

What tax records can you throw away?

10/13/2020

October 15 is the deadline for individual taxpayers who extended their 2019 tax returns. (The original April 15 filing deadline was extended this year to July 15 due to the COVID-19 pandemic.) If you’re finally done filing last year’s...

READ MORE >

Understanding the passive activity loss rules

10/12/2020

Are you wondering if the passive activity loss rules affect business ventures you’re engaged in — or might engage in?

If the ventures are passive activities, the passive activity loss rules prevent you from deducting expenses that are...

READ MORE >

More time: FASB delays long-term insurance standard … again

10/9/2020

On September 30, the Financial Accounting Standards Board (FASB) finalized a rule to defer the effective date of the updated long-term insurance standard for a second time. The deferral will give insurers more time to properly implement the...

READ MORE >

COVID-19 Update (October 2020)

10/7/2020

A message from our partners

Like many of you, we're continuing to follow the latest coronavirus developments. Our priority is to keep our team, their families and our valued clients safe and healthy. We are taking several steps to do our part and...

READ MORE >

There may be relief from tax liability for “innocent spouses”

10/6/2020

If you file a joint tax return with your spouse, you should be aware of your individual liability. And if you’re getting divorced, you should know that there may be relief available if the IRS comes after you for certain past-due...

READ MORE >

The easiest way to survive an IRS audit is to get ready in advance

10/6/2020

IRS audit rates are historically low, according to the latest data, but that’s little consolation if your return is among those selected to be examined. But with proper preparation and planning, you should fare well.

In fiscal year 2019, the...

READ MORE >

Gifts in kind: New reporting requirements for nonprofits

10/2/2020

On September 17, the Financial Accounting Standards Board (FASB) issued an accounting rule that will provide more detailed information about noncash contributions charities and other not-for-profit organizations receive known as “gifts in...

READ MORE >

The tax rules for deducting the computer software costs of your business

9/29/2020

Do you buy or lease computer software to use in your business? Do you develop computer software for use in your business, or for sale or lease to others? Then you should be aware of the complex rules that apply to determine the tax treatment of the...

READ MORE >

Why it’s important to plan for income taxes as part of your estate plan

9/29/2020

As a result of the current estate tax exemption amount ($11.58 million in 2020), many estates no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because...

READ MORE >

Compare and contrast: How do the Republican and Democratic tax plans differ?

9/28/2020

With the presidential election only weeks away, many people are beginning to pay closer attention to each candidate’s positions on such issues as the COVID-19 pandemic, health care, the environment and taxes.

Among their many differences,...

READ MORE >

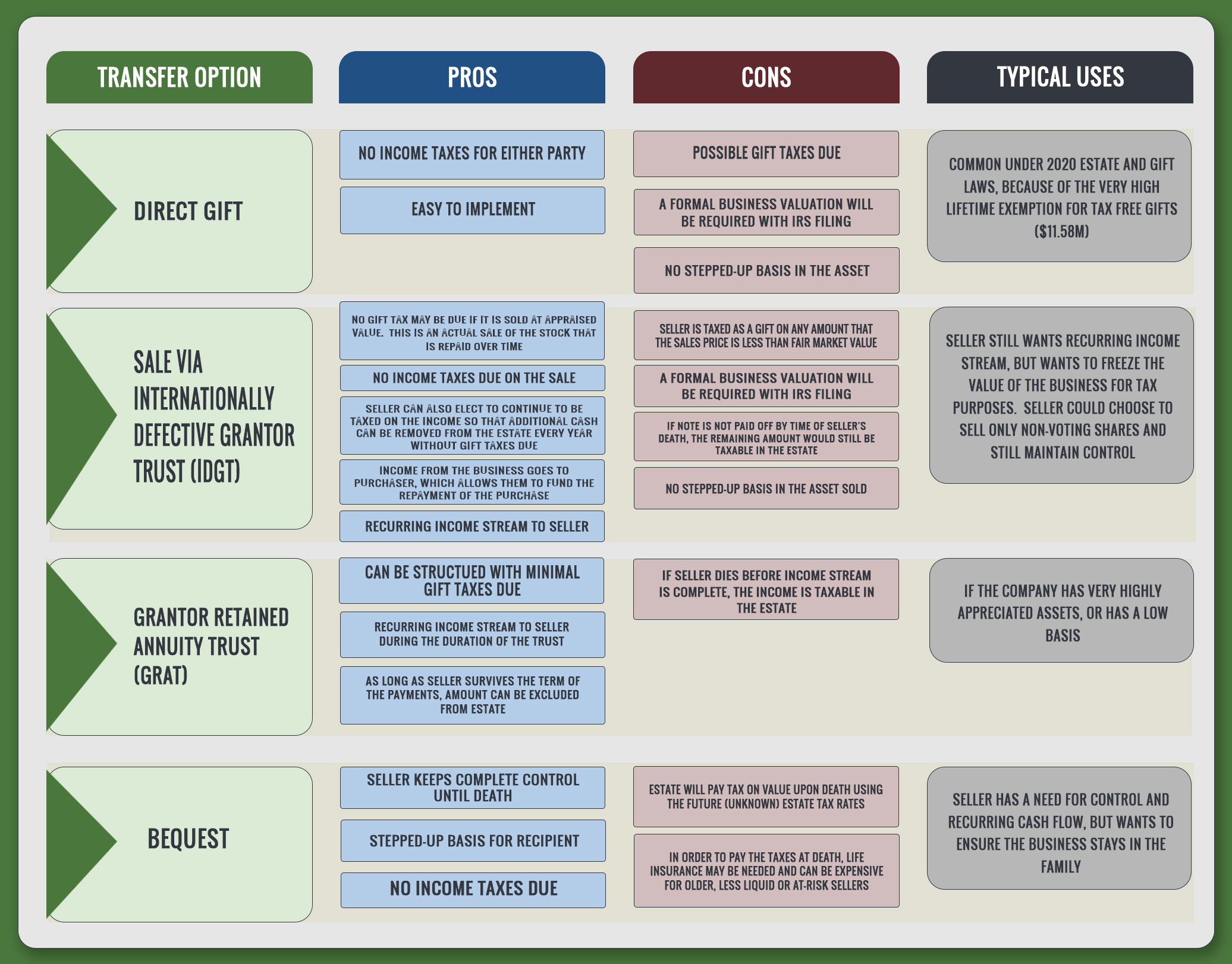

Does your family-owned business have a succession plan? Start planning early

9/25/2020

When it comes time to pass your family-owned business on to the next generation, there is an incredible array of questions you’ll need to answer and options to consider. It’s not as simple as handing them the keys to the door.

Includes insights from Richard L. Craig

READ MORE >

Can investors who manage their own portfolios deduct related expenses?

9/22/2020

In some cases, investors have significant related expenses, such as the cost of subscriptions to financial periodicals and clerical expenses. Are they tax deductible? Under the Tax Cut and Jobs Act, these expenses aren’t deductible through...

READ MORE >

Business website costs: How to handle them for tax purposes

9/21/2020

The business use of websites is widespread. But surprisingly, the IRS hasn’t yet issued formal guidance on when Internet website costs can be deducted.

Fortunately, established rules that generally apply to the deductibility of business...

READ MORE >

How to report COVID-19-related debt restructuring

9/18/2020

Today, many banks are working with struggling borrowers on loan modifications. Recent guidance from the Financial Accounting Standards Board (FASB) confirms that short-term modifications due to the COVID-19 pandemic won’t be subject to the...

READ MORE >

415 Group Ranked Among Most Elite 501 Managed Service Providers

9/18/2020

Canton, Ohio (August 19, 2020) — 415 Group, a certified public accounting, business consulting and IT services firm, has been named as one of the world’s premier managed service providers on the prestigious 2020 annual Channel Futures...

READ MORE >