News

Personal Tax

What Does it Mean if the IRS Files a Lien?

5/17/2017

It's bad enough when borrowers can't pay off amounts owed to commercial creditors such as banks and other financial institutions. But people can find themselves in really hot water if they owe the IRS money.

How a Levy Compares...

READ MORE >

Can Pension Benefits Be Deducted as Alimony?

4/8/2017

When married couples split up, the terms of the divorce or separation agreement can have a major tax impact. For example, any amounts paid for alimony are deductible by the payor and taxable to the recipient.

The Tax Definition of...

READ MORE >

4 Tips for Claiming Higher Education Credits

3/24/2017

The Internal Revenue Code offers two federal income tax credits for post-secondary education expenses: the American Opportunity credit, and the Lifetime Learning credit. (See "The Basics of Higher Education Credits" at right.)

The...

READ MORE >

IRS: Swap Your Vacation Home in Tax-Deferred Exchange

3/10/2017

Many taxpayers own vacation homes that they've rented out and also used as their personal residences. Can one of these homes be traded for another vacation home in a tax-deferred Section 1031 exchange? According to the IRS, the answer is "yes" under...

READ MORE >

IRS Allows Exceptions for Missed Retirement Account Rollover Deadlines

2/13/2017

You may know about the 60-day window for making tax-free rollovers of funds withdrawn from your IRA or other tax-favored retirement account. Here are a couple of things you might not know about the deadline:

1. The 60-day period begins the day...

READ MORE >

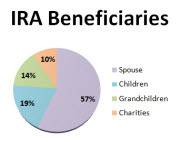

Leaving IRA Money to Charity: A Tax-Smart Strategy

1/16/2017

These days, many people have a large percentage of their wealth in the form of traditional IRA accounts. In most cases, this is because significant distributions have been rolled over tax-free from qualified retirement plans to these IRAs. A lot of...

READ MORE >

How to Set Up an IRS-Approved Family Loan

12/19/2016

Today's relatively low-interest-rate environment makes it easy to loan money to family members on favorable terms with full IRS approval. Here's a rundown of what the law covers and why now might be a good time to set up...

READ MORE >

IRS Extends Deadline to Provide 2016 ACA Forms to Recipients

12/2/2016

The IRS announced that it is extending one of the deadlines for providing 2016 Affordable Care Act (ACA) information statements to recipients.

Specifically, the due date for furnishing to individuals the 2016 Form 1095-B (Health Coverage) and the...

READ MORE >

It's Time for Individuals to Plan for Taxes in 2016 and Beyond

11/18/2016

Year end is rapidly approaching. It's now time to consider making some moves that will lower your 2016 tax bill and get you into position for tax savings in future years. This article offers some year-end planning tips for individuals — while...

READ MORE >

Can a Modest-Income Elderly Person Stop Filing Tax Returns?

11/18/2016

As the Old Saying Goes: Better Safe than Sorry.

As you know, we spend a lot of time in this e-newsletter talking about tax return filing responsibilities. But not everyone is required to file. If a person's income falls below prescribed levels, he...

READ MORE >

Can You Have Too Much Money in Tax-Deferred IRAs?

10/21/2016

In some cases, individuals reach a point where deferring taxes to the max is counter-productive.

There are several reasons why this happens. For one thing, while deferring taxes is a good idea when personal tax rates are going down or staying the...

READ MORE >

Did You Miss the 60-Day Deadline for Your IRA Rollover?

9/26/2016

If you miss the deadline for rolling over an IRA distribution to another IRA or eligible retirement plan, you could be subject to taxes and penalties. If you have a valid excuse, you may be able to obtain a hardship waiver from the IRS, but applying...

READ MORE >

Notify the IRS if You Change Your Address

9/26/2016

It's important to notify the IRS if you move and change your address. Under tax law regulations, a taxpayer's last known address is the one that appears on the tax return you filed most recently — unless the IRS is otherwise notified.

In...

READ MORE >

Will You Have to Pay Tax on Social Security Benefits?

8/30/2016

Some people are under the misconception that Social Security benefits are always free from federal income tax. However, depending on how much income you have from other sources, you may have to report up to 85 percent of your benefits as income on...

READ MORE >

Compare and Contrast the Republican and Democratic Tax Platforms

8/15/2016

With both major political party conventions finally behind us, it's time to focus on the upcoming national election. Among their many differences, the Republicans and Democrats have widely divergent tax platforms. While platforms are always...

READ MORE >

3 Taxes People Love to Hate

7/29/2016

Few people enjoy giving money to the IRS, but some types of taxes are viewed more unfavorably than others. Here are three worthy candidates vying for the title of most-hated tax.

Penalty Tax on Individuals without Health Insurance

As you...

READ MORE >

Tax Consequences of Borrowing From a Retirement Plan

7/29/2016

If you participate in a qualified retirement plan through your job or self employment -- such as a 401(k), profit-sharing, or Keogh plan -- you might be allowed to borrow from the account. (The borrowing option is not available for traditional IRAs,...

READ MORE >

IRA Charitable Donations: An Alternative to Taxable Required Distributions

7/21/2016

You can make cash donations to IRS-approved charities out of your IRA using so-called "qualified charitable distributions" (QCDs). This strategy may be advantageous for high-net-worth individuals who have reached age 70 1/2. It expired at the...

READ MORE >

Save Taxes with Employer-Provided Transportation Fringe Benefits

7/6/2016

The Internal Revenue Code allows some worthwhile tax breaks for transportation-related employee fringe benefits. They're intended to persuade you to give up your gas-guzzling vehicle when commuting to work and instead "go green." If your employer...

READ MORE >

What You Need to Know About 529 Plan Withdrawals

7/6/2016

The big advantage of Section 529 college savings plans is that withdrawals used to cover qualified higher education expenses are free from federal income tax (and usually state income taxes too). That part is very easy to understand, but the full...

READ MORE >