News

Personal Tax

Save Money With These Year-End Ideas

12/5/2019

There's still time to reduce your potential tax obligation and save money this year (and next). Here are some ideas to consider:

Estimate your 2019 and 2020 taxable income. With these estimates you can determine which year receives the...

Includes insights from Holly L. Lieser

READ MORE >

Time for a Yearly Credit Report

12/4/2019

One way to head off fraud during tax season is to get your free annual credit report now. Credit reports often have errors in them; this quick checkup can be the first indication that some form of identity theft has taken place on your account.

The...

READ MORE >

Another Year, Another New 1040

10/9/2019

In 2018, the government attempted to “simplify” the tax-filing process by drastically shortening Form 1040. The result was six new schedules that created a lot of confusion. Now the IRS is attempting to ease some of that pain by revising...

READ MORE >

Reminder: Time to Start the Financial Aid Process

10/9/2019

If you have a child in college or entering college during the next school year, you need to read this. You can now fill out your required Free Application for Financial Student Aid (FAFSA) for the next school year.

FAFSA...

READ MORE >

The IRS Is Not Always Right

9/17/2019

A letter in the mailbox with the IRS as the return address is sure to raise your blood pressure. Here are some tips for handling the situation if this happens to you:

Stay calm. Try not to overreact to the correspondence. They are often in...

READ MORE >

Help Older Adults Stand Up Against Scams

9/17/2019

The Consumer Financial Protection Bureau recently reported in financial exploitation cases that older adults lost an average of $34,200. Unfortunately, these funds are often never recovered. You can ensure this doesn't happen by learning more about...

READ MORE >

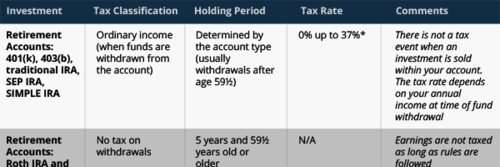

Consider the Tax Before You Sell

9/17/2019

In times of market volatility or when a financial need arises, it is only natural to consider selling some investments. Understanding the tax consequences is key to making an informed and planned decision. Here is what you need to know before you...

READ MORE >

Effective Tax Planning Starts Now

9/5/2019

With summertime activities in full swing, tax planning is probably not on the top of your to-do list. But putting it off creates a problem at the end of the year when there’s little time for changes to take effect. If you take the time to plan...

Includes insights from Todd J. Ruggles

READ MORE >

I Owe Tax on That?

8/14/2019

Wages and self-employment earnings are taxable, but what about the random cash or financial benefits you receive through other means? If something of value changes hands, you can bet the IRS considers a way to tax it. Here are five taxable items...

READ MORE >

Smart Tactics to Manage Student Debt

8/14/2019

According to the Federal Reserve, U.S. student loan debt is now $1.5 trillion with more than 44 million borrowers. Only mortgage debt currently has bigger numbers among types of consumer debt. Even worse, more than 10 percent of these loans are past...

READ MORE >

5 Summer Tax Savings Opportunities

6/6/2019

Ah, summer. The weather is warm, kids are out of school, and it’s time to think about tax saving opportunities! Here are five ways you can enjoy your normal summertime activities and save on taxes:

Rent out your property tax-free. If...

READ MORE >

Watch Out! 7 Vacation Costs That Sneak Up on You

5/29/2019

Going on vacation is a time to get away, relax and enjoy new experiences. But if you don’t pay close attention, extra costs can sneak up on you like tiny money-stealing ninjas. Here are seven sneaky vacation costs to watch out for:

Covert...

READ MORE >

You Know You Need Tax Planning If...

5/22/2019

Effective tax planning helps you make smart decisions now to get the future outcome you desire — but you need to make sure you don’t miss anything. Forget to account for one of these situations and your tax plans will go off the rails in...

READ MORE >

7 Common Missing Tax Return Items

3/18/2019

Want your tax return filed quickly and without error? Then double-check this list of items that are often overlooked. These missing items often cause delays in getting your tax return filed:

Forms W-2 and 1099. Using last year's tax return...

READ MORE >

Oh No! Your Tax Refund is Now a Bill

3/18/2019

If you are anticipating a nice refund this year, it may be a good idea to prepare yourself for a possible letdown. Many taxpayers will receive a smaller-than-expected refund and might even owe taxes to be paid by April 15. If this happens to you,...

READ MORE >

Tips to Protect Yourself From Tax Scams

2/20/2019

Too many people downplay the threat of identity theft because it hasn't been witnessed or experienced firsthand. This false sense of security can leave you exposed, especially during tax season. Here are some tips to keep your identity safe from...

READ MORE >

It's Your Money. Get it Back Now!

1/21/2019

According to Credit Karma, over $40 BILLION of unclaimed property is currently being held by state governments. That's a staggering amount of money — enough to buy half of the National Football League franchises. Not included in that figure is...

Includes insights from Kathleen S. Krohn

READ MORE >

6 Last-Second Money-Saving Tax Moves

12/11/2018

As 2018 winds down, there is still time to reduce your potential tax obligation. Here are some ideas to make your 2018 tax return less of a burden on your wallet:

Accelerate expenses. Individual taxpayers are on the cash basis...

READ MORE >

Five Tax Breaks for New Parents

12/5/2018

New parents have their work cut out for them. Not only are they dealing with lost sleep, they also face the extra cost of raising a child. At least there are a lot of potential tax breaks available to them. Check out this list and share it with any...

READ MORE >

Maximize the Tax Deductions Available for Your Generosity

6/6/2017

The reporting requirements for claiming charitable contributions of cash on your tax return can be strict. If you don't follow them, your deductions may be disallowed by the IRS. You should also be aware that stringent rules also apply to...

Includes insights from Natalie M. Simmons

READ MORE >